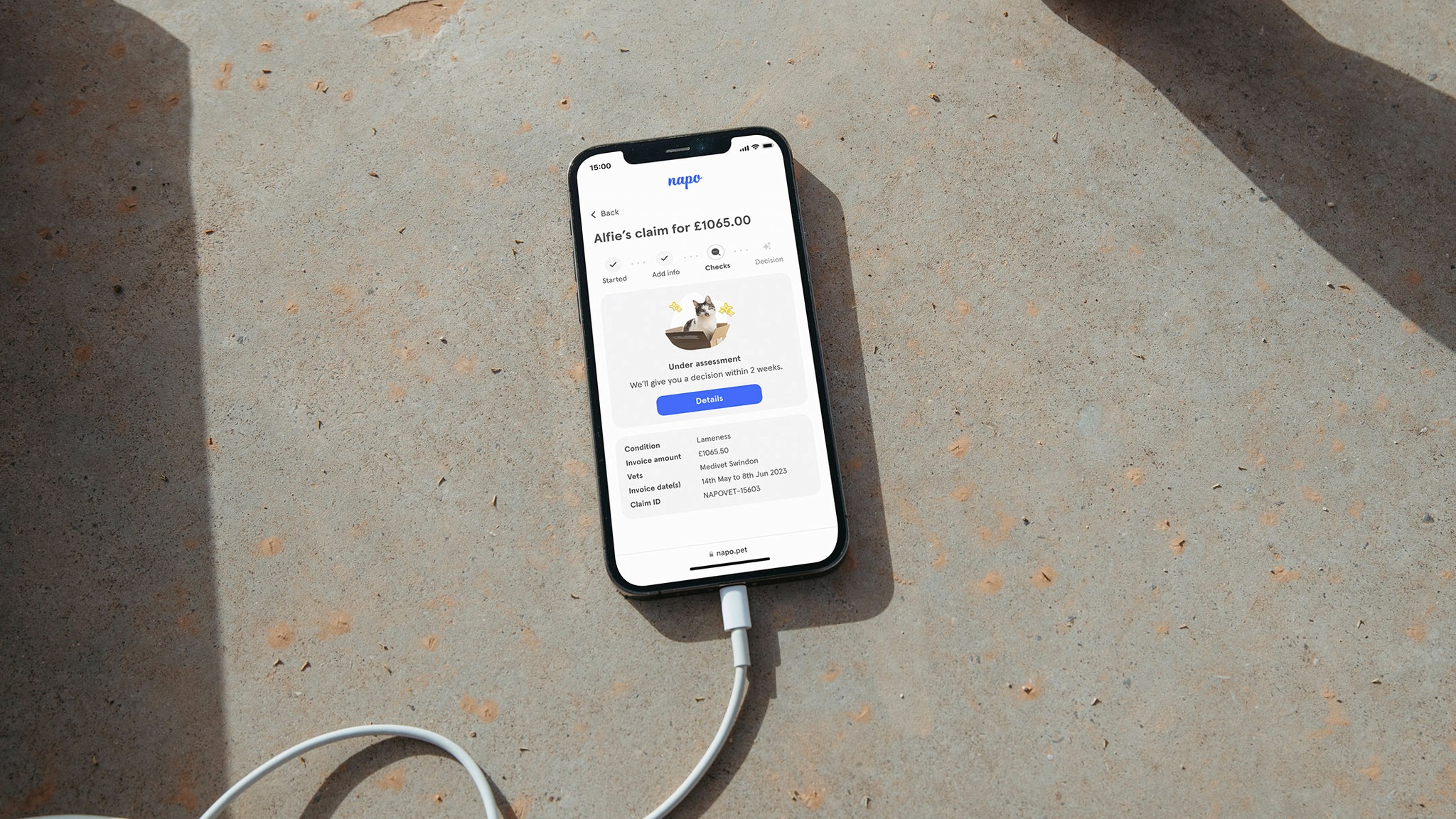

Napo customer claim experience

Having sold over 70,000 insurance policies in its first year, Napo faced the challenge of low assessment capacity and inability to consistently give people updates on their claim status.

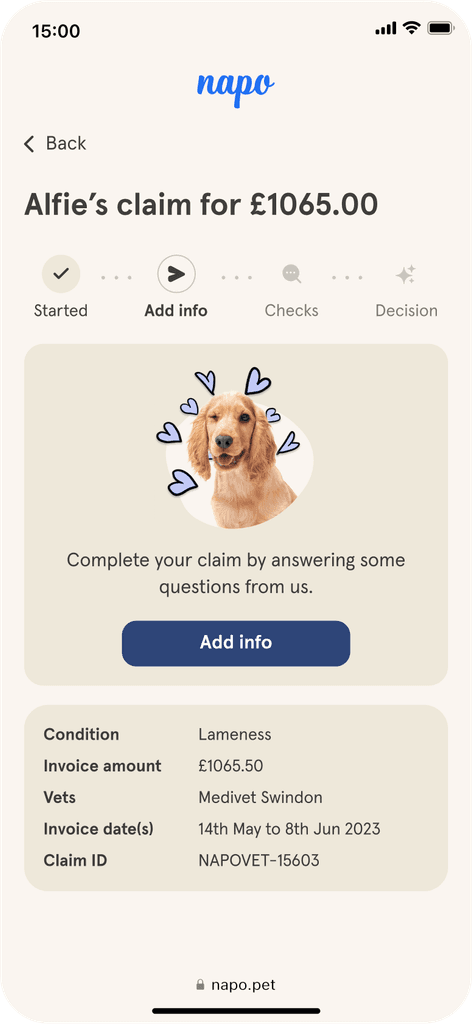

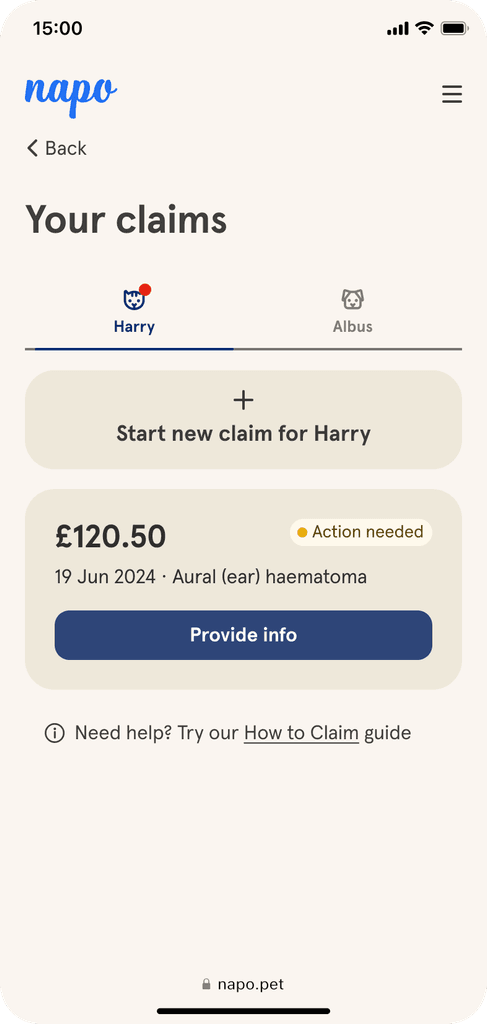

I redesigned the claim handling pipeline and customer-side UX, so that the new process would allow for more assessment tasks to be automated, and updates to be given automatically.

Headquarters

London, UK

Founded

2021

Industry

Pet Insurance

Revenue

TBC

Company size

50-100 people

Challenge

When I started at Napo, each insurance claim was a chain of emails. It would get picked up by different people, and the end-to-end process was 100% manual. Increasing volume made the assessment timelines unpredictable – which was hard to communicate to customers. The main goal of this project was to to digitise claim submission and automate as many steps as possible, so there's less chasing and more signposting.

Results

By introducing info submission and claim tracking experience, I've cut claim status queries by 73%, and eliminated manual info collection step from Inbound team's workflow. My work allowed to reduce average time to close a claim from 3+ weeks to ~5 days.

-73%

Claim status queries

x3

Service speed increase

97%

Customer satisfaction

Process

Discovery: I brought together Customer Champions and Claim Assessors to put together a mental model of Napo's claim service. We mapped the journey and voted on the most significant strains where claims get stuck.

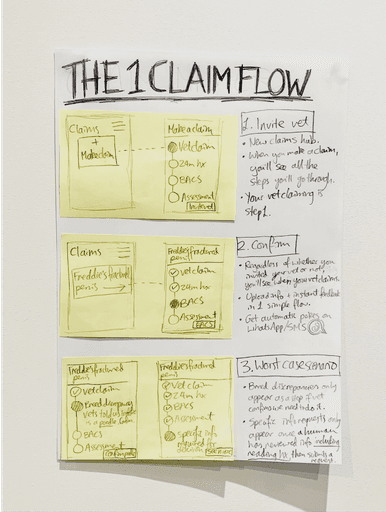

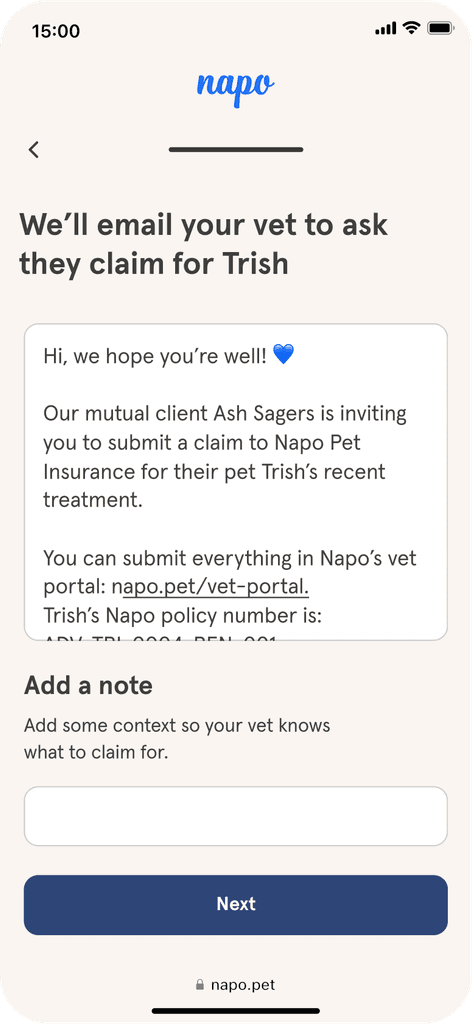

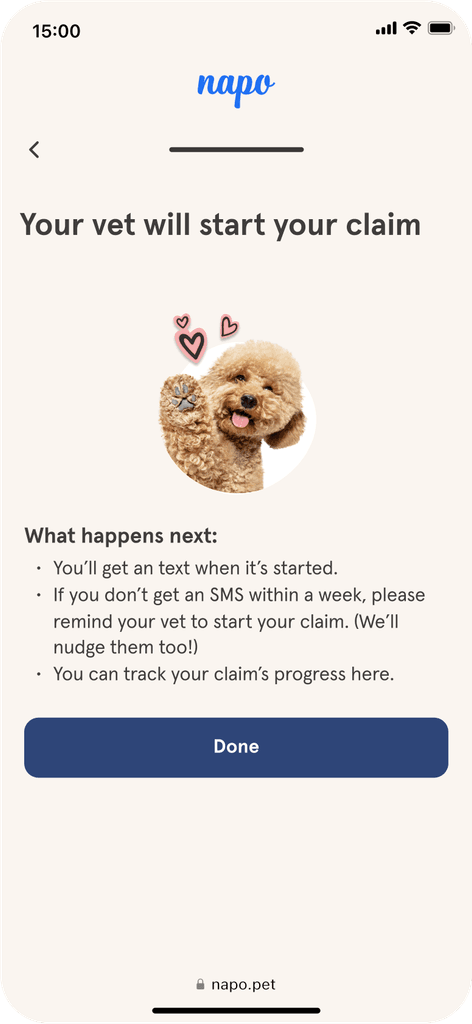

Information Architecture: Having evaluated each assessment step in terms of difficulty, duration and necessity, we decided that the best way to get impact was to tackle the manual document collections. These would be collected automatically upfront, in a claiming UX that services both communication and tracking.

Prototyping: I ran cross-functional workshops to gather requirements and design our prototype. We then refined visual design and tone of voice in our comms with the Design team.

Testing: I ran 10 moderated tests with Napo customers. Five of them had claimed before, the other five never claimed. This helped make this experience customer-centered and minimise any unnecessary steps.

Post-launch refinement: After a trial run, the incoming data was proven to be complete enough, so engineers saw an opportunity for identifying and automating low-risk claims, which we implemented later.

“Natasha's work on Claims UX allowed the business to overcome our assessment capacity shortage and drastically reduce the wait time: what used to take weeks now takes a few days max”

Amy Wei

Principle Product Manager

Conclusion

The new claim experience allows the customers to confirm the claim, submit documents, and track status. This made claim assessments 3x faster, and laid foundations for automating assessments.